Forex Brokers: Expert Reviews and Recommendations

Wiki Article

Deciphering the World of Foreign Exchange Trading: Uncovering the Value of Brokers in Handling Threats and Making Sure Success

In the elaborate world of forex trading, the duty of brokers stands as a crucial aspect that typically stays shrouded in mystery to numerous ambitious investors. The elaborate dancing between brokers and investors unveils a symbiotic relationship that holds the vital to unraveling the enigmas of successful trading endeavors.The Duty of Brokers in Forex Trading

Brokers play a critical role in forex trading by giving crucial services that aid investors manage dangers efficiently. One of the primary functions of brokers is to give investors with accessibility to the market by assisting in the execution of professions.In addition, brokers use take advantage of, which enables traders to control larger positions with a smaller sized quantity of funding. While utilize can enhance revenues, it likewise enhances the potential for losses, making threat monitoring essential in foreign exchange trading. Brokers give risk management devices such as stop-loss orders and restriction orders, permitting traders to set predefined exit indicate decrease losses and safe and secure revenues. In addition, brokers provide instructional sources and market evaluation to aid investors make notified decisions and create reliable trading methods. Overall, brokers are crucial companions for traders aiming to navigate the forex market efficiently and take care of risks effectively.

Threat Administration Approaches With Brokers

Provided the critical role brokers play in facilitating accessibility to the fx market and giving danger monitoring devices, understanding effective strategies for handling dangers with brokers is important for successful foreign exchange trading. One essential technique is establishing stop-loss orders, which allow investors to predetermine the optimum amount they are ready to lose on a profession. This device aids restrict potential losses and safeguards versus damaging market movements. Another essential danger monitoring method is diversification. By spreading out financial investments throughout various money sets and asset classes, traders can decrease their exposure to any kind of single market or instrument. Furthermore, using take advantage of cautiously is crucial for danger management. While leverage intensifies revenues, it additionally magnifies losses, so it is vital to make use of leverage sensibly and have a clear understanding of its implications. Lastly, keeping a trading journal to track performance, evaluate previous professions, and determine patterns can assist investors fine-tune their strategies and make more enlightened choices, ultimately boosting risk administration techniques in foreign exchange trading.

Broker Selection for Trading Success

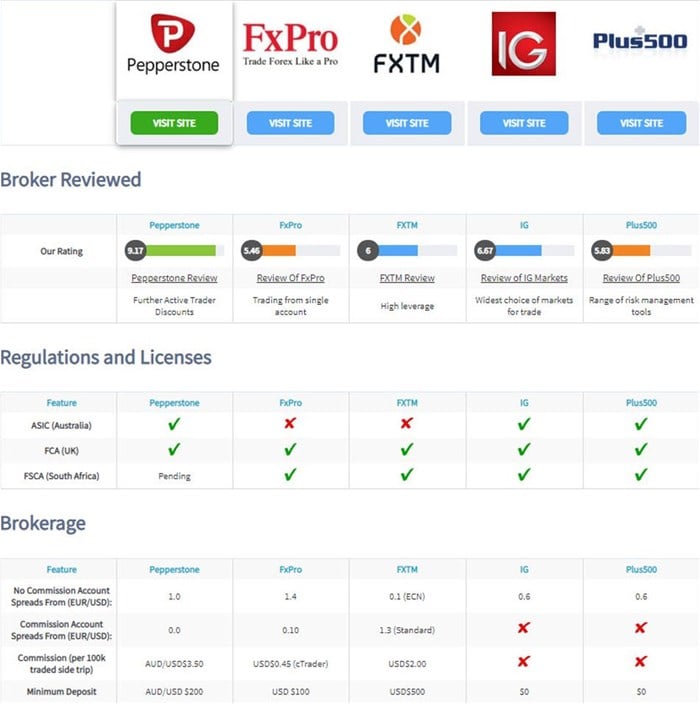

Choosing the best broker is extremely important for accomplishing success in foreign exchange trading, as it can dramatically affect the general trading experience and end results. Functioning with a regulated broker provides a layer of safety and security for investors, as it makes certain that the broker operates within set standards and standards, hence decreasing the threat of scams or malpractice.In addition, investors need to analyze the broker's trading platform and devices. Analyzing the broker's client support services is important.

Moreover, investors must review the broker's fee structure, consisting of spreads, compensations, and any kind of hidden fees, to recognize the expense implications of trading with a particular broker - forex brokers. By thoroughly evaluating these variables, traders can pick a broker that straightens with their trading objectives and sets the phase for trading success

Leveraging Broker Experience for Earnings

How can investors properly harness the know-how of their selected brokers to make the most of success in click resources foreign exchange trading? Leveraging broker knowledge for earnings requires a tactical approach that includes understanding and using the services used by the broker to enhance trading end results.Furthermore, traders can benefit from the support and assistance of experienced brokers. Establishing a great connection with a broker can result in individualized suggestions, trade referrals, and danger administration techniques customized to private trading styles and objectives. By interacting frequently with their brokers and looking for input on trading approaches, investors can tap right into expert understanding and enhance their total efficiency in the forex market. Ultimately, leveraging broker expertise commercial involves energetic interaction, constant learning, and a collective technique to trading that optimizes the possibility for success.

Broker Support in Market Evaluation

Broker aid in market analysis expands beyond just technical evaluation; it also encompasses fundamental evaluation, view analysis, and danger monitoring. By leveraging their experience and accessibility to a large range of market information and research study tools, brokers can help investors navigate the intricacies of the forex market and make educated decisions. In addition, brokers can supply timely updates on financial events, geopolitical growths, and other factors that might affect currency rates, allowing investors to stay in advance of market variations and change their trading settings appropriately. Eventually, by using broker support in market analysis, investors can boost their trading efficiency and increase their opportunities of success in the competitive foreign exchange market.

Conclusion

To conclude, brokers play a vital duty in foreign exchange trading by handling risks, giving competence, and helping in market evaluation. Selecting the ideal broker is important for trading success and leveraging their expertise can lead to earnings. forex brokers. By making use of threat monitoring techniques and working very closely with brokers, traders can navigate the complex globe of forex trading with confidence and enhance their opportunities of successGiven the important role brokers play in assisting in access to the foreign exchange market and giving risk administration devices, comprehending effective techniques for handling threats with brokers is vital for effective forex trading.Choosing the right broker is critical for attaining success in forex trading, as it can considerably affect the general trading his response experience and outcomes. Working with a regulated broker supplies a layer of safety for traders, as it ensures that the broker operates within set guidelines and standards, hence reducing the danger of fraud or negligence.

Leveraging broker proficiency for earnings calls for a critical approach that includes understanding and making use of the services provided by the broker to enhance trading results.To successfully exploit on broker knowledge for profit in forex trading, traders can count on broker help in market evaluation for educated decision-making and threat mitigation approaches.

Report this wiki page